700Credit LLC

About

700Credit focuses on delivering the most robust, bureau-inclusive credit, compliance, soft pulls and identity verification, and driver’s license authentication solutions on the market today. We serve over 21,000 dealerships and have integration partnerships with 200+ leading DMS, CRM, Service Lane, Desking, Digital Retailing, and Website providers.

We offer credit reports from Experian, Equifax, and TransUnion. Our volumes enable us to offer credit reports at very competitive prices.

Our best-in-class compliance solutions are designed to keep our dealers in compliance with the law seamlessly with every transaction. We offer OFAC compliance, Red Flag solutions, score disclosure notices, adverse action notices, Military Lending Act (MLA), Synthetic ID detection and more.

Our soft-pull solutions are designed to provide our dealers with critical credit file information at the beginning of the sales process so dealers can present the right offer, right away. We offer both consumer-facing pre-qualification and dealer-facing prescreen solutions. Neither require the customer's SSN or DOB so there is no effect on the consumer’s credit file.

We offer a complete range of identity verification and fraud detection solutions to protect your business from fraudsters. Our products include ID verification, synthetic ID fraud detection, Income and Employment verification, and driver’s license authentication – both in store and mobile solutions. For more information, visit our website at: www.700credit.com.

QUICK FAMILY

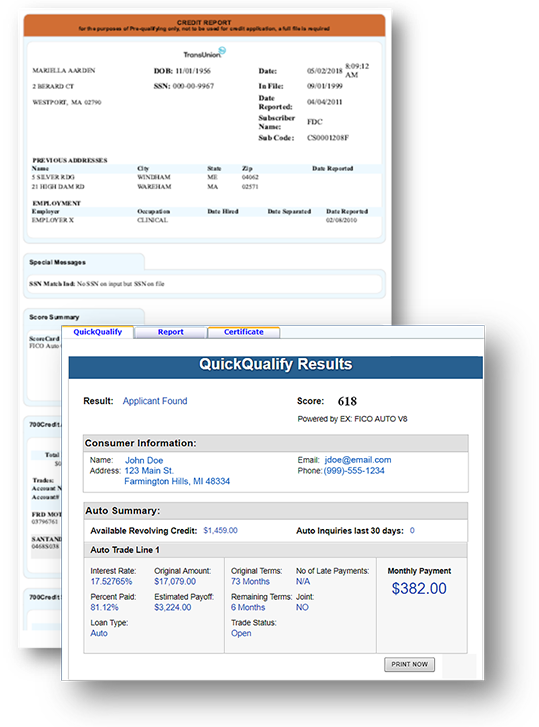

QUICKQUALIFY: Web-based Soft Pull Solution

Do you want more qualified leads from your dealership website? Who doesn’t!

QuickQualify is a web-based pre-qualification solution that utilizes a credit bureau soft pull which drives higher consumer engagement without requiring an SSN or DOB. QuickQualify has been proven to increase the number of leads dealers get from their website by an average of 3-4 times! Here are a few points to know about QuickQualify:

- Provides access to your customer’s full credit report and FICO score – before they walk into your dealership so you can work the right deal, right away!

- This is a soft-pull solution that does not affect the consumer’s credit score.

- Provides the consumer’s live FICO score as well as insight into auto loans, interest rates, payments & more

- Soft pull scores align with your finance office so there are no surprises.

- Data can be automatically populated in your CRM, DMS, DealerTrack, RouteOne and CUDL

- The strategic placement of banners and buttons drives consumer engagement. We work with dealers to provide our best practices for banner placement that drives the most consumer engagement.

QuickQualify summary results returns the following information to the dealer:

QuickQualify summary results returns the following information to the dealer:

- Live FICO Score

- Available Revolving Credit

- Auto Inquiries in last 30 days

- Summary of all the auto trade lines including:

- Current Monthly Payments

- Current Auto Loan Interest Rate

- Remaining Balance / Payoff Payment History Months

- Remaining balance on Auto Loans

- Dealers can also receive a full credit file

- Note: This full file can not be used to fund the deal. A separate hard pull will have to be done.

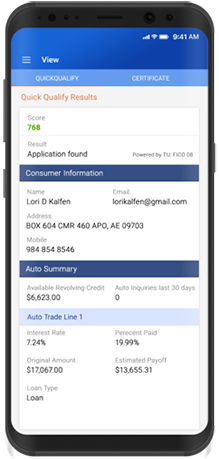

QUICKQUALIFY MOBILE DEALER APP

QUICKQUALIFY MOBILE DEALER APP

QuickQualify is a web-based platform and pre-qualification solution that drives greater consumer engagement, and it provides a full credit profile and FICO score without requiring a SSN or DOB.

The Mobile Dealer App is specifically designed for easier management of a dealership’s soft-pull leads generated by the QuickQualify solution. Dealers are immediately alerted when new leads are available and can view their leads quickly and conveniently from their mobile device!

From this simple interface, you can:

- Receive alerts immediately to their phone when consumers complete the QuickQualify web form

- Optimize interactions with consumers through text and mobile dialing

- View all applicants and immediately click to view an applicant’s credit score and credit file information

- Dealers can forward the QuickQualify URL via text or email to consumers to complete from their devices

iOS & Android Formats

iOS & Android Formats

The 700Credit Mobile Dealer App is available for both mobile phone (iOS & Android) and tablet formats. It is free for QuickQualify customers and can be downloaded from the Apple and Android App Stores by searching for “700Credit”.

Each format includes a secure login screen for safe and easy access to all your pre-qualified applicants.

Installing the app does require your correct email address or cell phone be set up on your account to verify your user ID. Please contact our support team if assistance is required: (866) 273-3848.

QUICKAPPLICATION: Web-based Finance Application

If you’re not using electronic credit applications, your process is not secure. The 2022 FTC Safeguards Rule requires strict security measures for capturing and storing sensitive consumer data and discourages the use of paper credit applications. 700Credit’s QuickApplication is captured electronically and stored in our secure servers to ensure compliance with the Rule.

QuickApplication is a web-based finance application that replaces the current credit application on your website. QuickApplication puts your customers in control, minimizing the number of fields they need to fill out versus a standard credit application. QuickApplication can automatically populate your CRM, DMS, DealerTrack, RouteOne, or CUDL.

Product features include:

Product features include:

- Automatically email risk-based pricing notices, as well as adverse action letters for those who fail to receive financing

- Consumer credit data stored securely in the 700Dealer customer portal for easy access and audit capabilities

- Consumer authorization to access their credit file letter is automatically generated and stored for easy dealer access

- All consumer data is available from within dealer’s personal 700Dealer.com web portal

- Data can be automatically populated in your CRM, DMS, DealerTrack, RouteOne and CUDL

- Can be automatically inserted into the digital deal jacket.

QUICKSCREEN – Dealer Driven Prescreen Soft-Pull Platform

Eliminate the guesswork when working a deal – with QuickScreen Prescreen from 700Credit!

What if you knew your customer’s FICO score and auto credit profile as soon as they walked into your dealership – or drive in for service? What if you had a solution to prioritize inbound leads before you pick up the phone? QuickScreen is integrated with your CRM, so it is easy to access, easy to use. QuickScreen gives you visibility into your customer’s credit profile before you work a deal, so you can work the right deal, right away, saving time and preventing a potentially uncomfortable situation for your customer.

Our QuickScreen platform integrates seamlessly with most CRM, DMS and Digital Retail platforms on the market today. When you run a QuickScreen on a customer, the following data is returned to the dealer:

- Live FICO Score

- Available Revolving Credit

- Auto inquiries last 30 days

- Summary of Auto Trade Lines Including:

- Current Monthly Payment

- Current Auto Loan Interest Rate

- Original loan term

- # of late payments

- Remaining Balance, Term, and Estimated Payoff

QuickScreen can be used in several scenarios within your dealership to:

- Qualify and prioritize inbound and internet leads

- Integrate into your Digital Retailing platform to provide accurate monthly payments using live credit data

- Mine for opportunities within your CRM

- Pre-qualify in-store shoppers

- Sell cars in the service lane

Driver’s License Authentication – Mobile and In-Store Solutions

Protect your store with the industry’s most advanced data capture and driver’s license authentication solutions for automotive retailers today. Dealership fraud is on the rise, with over 65% of dealerships admitting they have lost at least 15 cars to fraudsters in the past year.

We have 2 platforms for dealers to authenticate customers – both remotely and in-store. Our solutions empower dealers to identify – and stop – fraud at the TOP of the sales funnel.

|

|

|

| Mobile Scanner | Physical Scanner |

Our mobile scanner - QuickScan - is a powerful mobile document authentication platform that provides dealerships with real-time confirmation of the legitimacy of a customer’s driver’s license and identity. It can be used for both in-store and remote customers to verify the identities of car buyers before the first test drive.

The ID Drive physical scanner provides dealers with the most comprehensive physical driver’s license scanning solution for automotive dealers today. This platform combines our prescreen & prequalification platforms, and our suite of Identity Verification tools including Red Flag & Synthetic Fraud detection to deliver fast, accurate results.

Benefits of Driver’s License Authentication

- Verify the identity of your customer at the top of the sales funnel

- Provides Driver’s License/Document Verification

- Selfie Verification/Liveliness Detection

- Front/Back Driver’s License Validation

- Device Verification

- DMV Validation

- Synthetic ID Fraud Detection

- Automatically sent to your electronic deal jacket

Connect with us:

Contact

31440 Northwestern Highway, Suite 250

Suite 250

Farmington Hills, Michigan

48334

United States of America